Coupon Interest and Yield for eTBs

What is the Coupon Interest Rate?

The Coupon Interest Rate on a Treasury Bond is set when the bond is first issued by the Australian Government, and remains fixed for the life of the bond. For example, a Treasury Bond with a 5% Coupon Interest Rate will pay investors $5 a year per $100 Face Value amount in instalments of $2.50 every six months. These instalments are called Coupon Interest Payments.

What is the Yield To Maturity?

Yield to Maturity is the rate of return on a bond (expressed as an annual rate) if purchased at the current market price and held until the Maturity Date. The calculation of the yield assumes all Coupon Interest Payments are reinvested at the same rate.

What is the difference between Coupon Interest Rate and Yield To Maturity?

Yield To Maturity will vary through time with changes in the price and remaining term to maturity of the bond. The Coupon Interest Rate is set when the bond is first issued and remains fixed for the life of the bond. As a result, the Coupon Interest Rate will usually be different from the Yield To Maturity.

How does the ex-interest settlement date affect my coupon interest entitlement?

If you become a holder of an Exchange-traded Treasury Bond (eTB) and had settled the transaction at the Record Date (the close of business eight calendar days before the Coupon Interest Payment Date), you will be entitled to the next Coupon Interest Payment. If this day is not a Business Day, the preceding Business Day is the Record Date.

The ex-interest settlement period for eTBs is the period after the Record Date up to and including the next Coupon Interest Payment Date. Transactions settled during the ex‑interest period are not entitled to the next Coupon Interest Payment.

Example 1: The 2.75% 21 November 2028 Treasury Bond makes a Coupon Interest Payment on Thursday 21 November 2019. The Record Date for this Coupon Interest Payment is Wednesday 13 November 2019.

Example 2: The 5.50% 21 April 2023 Treasury Bond makes a Coupon Interest Payment on Monday 21 October 2019. The Record Date for this Coupon Interest Payment is Friday 11 October 2019 (ten days before the Coupon Interest Payment Date, since the date eight days before the Coupon Interest Payment Date falls on a weekend).

How will my coupon interest be paid?

Coupon Interest Payments for eTBs are paid every six months. If the Coupon Interest Payment Date is not a Business Day, the payment will be made on the next Business Day. You can see when the next Coupon Interest Payment Date for a particular eTB series on the List of eTBs page

The Australian Government’s preferred method of payment to all investors is by direct credit into an Australian dollar bank account with a financial institution in Australia.

- Residents of Australia, United States, Great Britain, New Zealand and Canada

Australian, United States, Great Britain, New Zealand and Canadian resident investors must nominate a valid Australian bank account, otherwise payments will be withheld until a valid account is provided. - Residents of other jurisdictions

Payments to investors that reside outside the above-mentioned jurisdictions will be made by paper cheque where a valid account has not been provided.

All investors are required to supply their payment instructions no later than the Record Date in order to receive their payment.

If you are already an eTB holder and wish to change your payment details, please contact Computershare Investor Services Pty Limited.

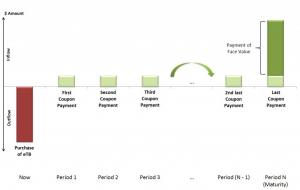

How do eTB cash flows work?

eTBs pay semi-annual coupon payments over the life of the bond. At maturity the final coupon is paid along with the Face Value of the bond.

Figure: Stylised representation of eTBs payments

(Actual amounts will vary depending on the individual eTB)